Introduction

On November 19, 2025, Adobe announced it will acquire Semrush in an all-cash transaction valued at approximately US$1.9 billion. —Adobe News, Search Engine Journal

For marketers, agencies and in-house teams across Canada — particularly in Ontario’s vibrant digital economy — this move signals a major shift in how brand visibility, SEO and emerging generative-AI-led search are evolving.

In this post we’ll explore what the acquisition is, why it matters, how it affects the Canadian market, and what practical steps marketers in Ontario should consider.

What is the deal?

Adobe will acquire Semrush, paying US$12.00 per share, representing a premium over Semrush’s recent trading value. —Search Engine Journal

Semrush is a leading online‐visibility and SEO platform: keyword research, competitive intelligence, site audits, backlink tracking, and more. —Wikipedia

According to Adobe’s own announcement: “Brand visibility is being reshaped by generative AI, and brands that don’t embrace this new opportunity risk losing relevance and revenue.” —Adobe News

The deal is expected to close in the first half of 2026, pending regulatory and shareholder approvals. —Adobe News

Why Adobe is doing this

From Adobe’s perspective, Semrush brings:

-

Deep SEO and brand-visibility expertise and data.

-

Tools focused on “generative engine optimization” (GEO) — visibility within AI-driven search and large-language-model (LLM) frameworks. —TechCrunch

-

The ability to integrate those capabilities into Adobe’s Experience Cloud and analytics offerings. —Adobe News

In short: as search and discovery shift (thanks to AI, chatbots, voice and other interfaces) brands want to be found not just via Google organic, but via AI-assistants, LLM-responses and other emerging “search” vectors. Semrush is positioned to help with that; Adobe wants to own more of the stack.

What it means for SEO and digital marketing — especially in Canada & Ontario

This acquisition has several implications:

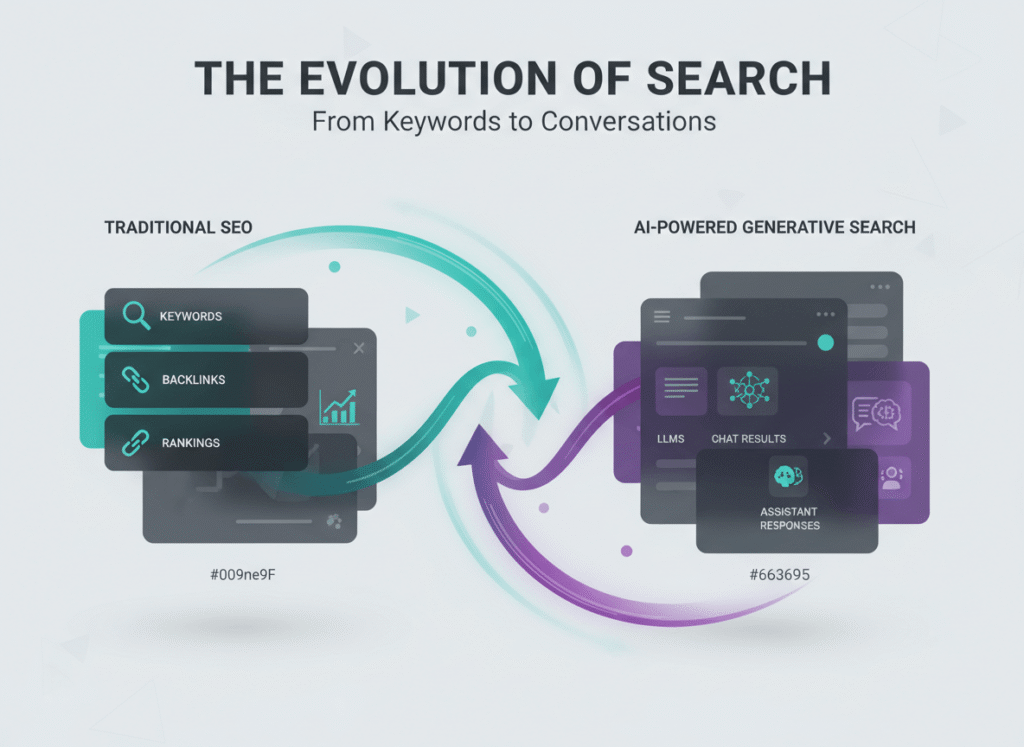

SEO is evolving:

Traditional SEO (keywords, links, technical performance) is still important. But what’s emerging is “visibility in AI-led interfaces” (GEO). Marketers need to ask: how does my brand show up when users ask a question to ChatGPT-style assistants, or when Google’s search results incorporate AI summaries rather than just 10 blue links?

Enterprise/agency stack consolidation

With Adobe acquiring Semrush, tools that used to be standalone may become part of larger suites — integration with analytics, content production, digital asset management, customer experience platforms. For Canadian agencies and Ontario in-house teams, this could impact tool choice, pricing and workflow.

Canadian / local market nuance

Canada, and Ontario in particular, have vibrant digital marketing sectors — from Toronto to Ottawa to the GTA and beyond. The acquisition means:

-

Canadian marketers should monitor how pricing and licensing evolve post-acquisition (will Adobe re-package Semrush for enterprise only?).

-

Local SEO (e.g., Ontario cities or regional focus) may benefit if the combined stack better supports multi-regional or bilingual (English + French) workflows.

-

As AI-led search grows globally, Canadian brands must ensure they are visible not just domestically but in how they are surfaced by generative platforms — even if those platforms are US-based.

-

Competitive advantage: For brands in Ontario that adopt early and integrate audit, content and AI-visibility workflows, this could be a differentiator. For those that wait, the risk is being a step behind in visibility when AI platforms become mainstream.

Potential challenges and questions

-

Tool independence: Will Semrush continue to operate as a stand-alone product (for small/mid-sized businesses) or will Adobe migrate it into enterprise tiers only?

-

Pricing & licensing changes: Post-acquisition, pricing structures might shift. Canadian businesses should monitor this.

-

Integration & transition: Merging two large product stacks is complex. Expect transition period, possible disruption.

-

Data sovereignty / Canadian privacy: Canadian businesses using US-based tools should continue to check privacy/compliance, especially with additional data flows through AI/LLM systems.

-

Vendor lock-in risk: If Adobe bundles more features (analytics, content management, SEO, AI visibility) into one suite, some agencies may face higher switching costs.

Actionable steps for marketers and agencies in Ontario

Here are five practical steps:

-

Audit your current SEO & visibility tools — Identify whether you use Semrush (or similar platforms), what data you pull, how you report to clients or stakeholders.

-

Assess readiness for AI/GEO visibility — Evaluate whether your content and web presence are optimized not just for search engines, but for AI/assistant interfaces (structured data, answer-style content, conversational queries).

-

Prepare for tool-stack evolution — If you’re an agency or digital team, map your tool dependencies (SEO platform, analytics, content generation, digital asset management) and consider how an acquisition might affect costs or workflows.

-

Localize your strategy — If you serve Ontario or Canadian clients, ensure regional keywords, bilingual considerations, local search factors are baked in; anticipate how AI platforms treat localized queries (“best Vancouver digital agency” vs “best Toronto digital marketing”).

-

Stay agile — With rapid change ahead, maintain flexibility. Consider piloting new visibility dashboards, watching for announcements from Adobe/Semrush, and being ready to pivot tools or strategies as needed.

What this means for smaller Canadian businesses

Often the headlines focus on large enterprises, but the implications for smaller businesses matter too:

-

Smaller firms may get access (or lose access) to advanced features previously only for enterprise.

-

Tool pricing changes may trickle down or push some businesses to alternative platforms.

-

Content and SEO strategy will increasingly need to consider AI-led visibility — so agencies servicing small businesses should be ready for that shift.

The broader market context

This move by Adobe follows a trend of consolidation in the digital marketing tool-space, and accelerates the focus on AI-driven visibility. According to Adobe’s announcement, traffic from generative AI sources to U.S. retail sites increased by 1,200% year-on-year in October. —TechCrunch

For Canada, while exact figures may differ, the direction is the same: expect search/discovery to shift beyond traditional search engines. The timing makes this a pivotal moment for digital strategy.

Looking ahead: What to watch

-

Regulatory approvals and closing timeline (expected H1 2026). Adobe News+1

-

How Adobe announces integration plans (will Semrush products stay standalone? Will bundles be introduced?).

-

Pricing/licensing changes in Canada.

-

SaaS tool ecosystem reactions — will competitors ramp up features (e.g., AI visibility) to counter the combined Adobe-Semrush stack?

-

Case studies from Canadian agencies showing early wins (or pitfalls) from changed workflows.

Conclusion

In summary: Adobe acquiring Semrush is a landmark event for digital marketing. For Canadian and Ontario-based marketers, this is more than a headline — it signals a shift in how visibility will be earned in a world increasingly shaped by AI, LLMs and generative interfaces. By auditing your current tools, adapting to GEO (generative engine optimization), and localizing your strategy, you can position yourself ahead of the curve rather than playing catch-up.

If you’d like a deeper dive on how to assess your tool stack, prepare a GEO roadmap or adapt content strategy for AI-driven discovery (especially for the Ontario market), we’d be happy to help.